As the Climate Council notes in its recent report[i], “there is no safe level of global warming. Already, at a global average temperature rise of 1.1°C, we’re experiencing more powerful storms, destructive marine and land heatwaves, and a new age of mega-fires”.

Earth Day 2021[ii]– held every year on April 22 – will likely see the announcement of bold plans to take action to address this problem. Historically Earth Day has been the catalyst of many environmental developments such as the creation of the United States Environmental Protection Agency and the passage of other first of their kind environmental laws.

This year, US President Biden hosted a global leader’s Climate Summit where key world leaders were invited to make new, enhanced emissions reduction commitments—so-called nationally determined contributions (NDCs)—to reduce their global warming emissions. Earth Day 2021 saw the announcement of some bold plans to take action to address this problem; US President Biden committed the US to halve greenhouse gases by 2030 compared to 2005 and the UK, Canada and Japan all raised their climate ambitions. In contrast, Australia did not update its emission reduction commitments.

Governments representing over 60% of the world’s greenhouse gas emissions are now committed to net-zero emissions goals, the majority by 2050.

“Australia, as a major emitter in its own right and a giant of the global fossil fuel economy, has a major role to play in the global effort to stabilise the climate. Bold and decisive climate action ultimately protects us and is in our national interest.”

Reference from Climate Council’s Aim High, Go Fast report [iii]

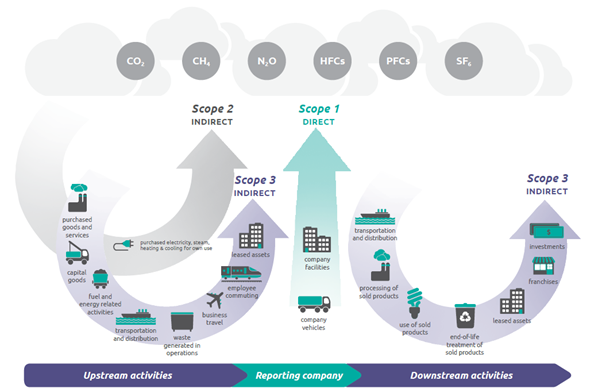

The key emissions reduction challenge for companies is that typically the vast majority of emissions occur in the value chain – Scope 3[iv] emissions – which are complex and difficult to measure, let alone manage.

Climate Action in the Value Chain – the Challenge of Scope 3 Emissions Reduction

By definition, a company’s Scope 3 GHG[v] emissions – indirect GHG emissions that occur in the value chain of the reporting company- occur outside of the company’s operated assets and are emissions over which they do not have operational control.

The lack of direct control and difficulty collecting high quality data typically make the measurement and targeting of Scope 3 emissions difficult. Consequently, until recently, corporates have largely focused their attention on emissions under their own operational control and from their purchases of electricity (Scope 1 and Scope 2 emissions), despite the fact for many companies Scope 3 emissions represent the majority of emissions.

Overview of GHG Protocol scopes and emissions across the value chain

Australia’s Scope 3 Emissions Reduction Challenge is Significant

Australia’s Scope 3 challenges are much larger relative to other countries. Using EMMI’s[vi] proprietary emissions modelling, scope 3 emissions represent 88% of ASX 300 emissions compared to 75% for the global universe[vii] .

Furthermore, only 6% of ASX300 companies are considered by EMMI as providing accurate disclosure of their Scope 3 emissions, either because Scope 3 emissions are not disclosed at all, only a portion of Scope 3 emissions are disclosed, or the estimates of scope 3 emissions are inaccurate because collecting of data typically make measurement difficult.

The disproportionate size of Australian company’s Scope 3 emissions and the weak starting point given the poor data quality therefore make the management of Scope 3 emissions a particularly challenging issue.

The Importance of Scope 3 Measurement and Targets

Despite these challenges, for the same reasons that companies are targeting Scope 1 and Scope 2 emissions reductions, targeting Scope 3 emissions reductions is important for:

- mitigating risks within company value chains. For example, Rio Tinto (not held) identifies thermal coal, oil and gas and metallurgical coal as having higher scope 3 risk because of substitution risks from renewables and hydrogen

- unlocking new innovations and collaborations

- responding to mounting pressure from investors, customers and civil society

- preventing the worst impacts of climate change

Examples of companies taking Scope 3 action

TLS (held): Telstra is partnering with its suppliers to improve the data quality of its supply chain emissions to manage and reduce its overall scope 3 emissions footprint.

RIO (not held): has developed the following Scope 3 goals:

- Working in partnerships with customers on steel decarbonisation pathways and investing in technologies that could deliver reductions in steelmaking carbon intensity of at least 30% from 2030;

- Working in partnerships to develop breakthrough technologies with potential to deliver carbon neutral steelmaking pathways by 2050;

- Work in partnerships to develop breakthrough technology enabling the production of zero-carbon aluminium;

- ambition to reach net zero emissions from shipping products by 2050.

Melior’s Response

Melior actively engages with companies to include targeting a reduction in scope 3 emissions in their transition targets and shares examples of best practice companies already moving towards identifying and managing scope 3 emissions.

Glossary

Scope 1: Direct GHG emissions that occur from sources that are owned or controlled by the reporting company, i.e., emissions from combustion in owned or controlled boilers, furnaces, vehicles, etc.

Scope 2: Indirect GHG emissions from the generation of purchased or acquired electricity, steam, heating, or cooling consumed by the reporting company. Scope 2 emissions physically occur at the facility where the electricity, steam, heating, or cooling is generated.

Scope 3: All other indirect GHG emissions (not included in scope 2) that occur in the value chain of the reporting company. Scope 3 can be broken down into upstream emissions that occur in the supply chain (for example, from production or extraction of purchased materials) and into downstream emissions that occur as a consequence of the use of the organization’s products or services.

Tim King is the Chief Investment Officer at Melior. He’s worked in capital markets for more than 25 years and has over a decade of experience in ESG research.

Melior Investment Management is a Sydney based impact investment manager that’s committed to driving positive change through investing in high-performing public market companies.

[i] “Aim High, Go Fast:Why emissions need to plummet this decade” https://www.climatecouncil.org.au/resources/net-zero-emissions-plummet-decade

[ii] https://www.earthday.org/earth-day-2021/

[iii] “Aim High, Go Fast:Why emissions need to plummet this decade” https://www.climatecouncil.org.au/resources/net-zero-emissions-plummet-decade

[iv] See glossary

[v] Green House Gas

[vi] https://www.emmi.io/

[vii] Circa 30,000 of the largest global companies