There’s a major disconnect between the Net Zero commitments of Australia’s largest industrial companies, and their progress towards decarbonisation.

Leading global engagement network, Climate Action 100+, has released an interim report (the last was 6 months ago) which shows a lack of progress on credible decarbonisation strategies, despite plenty of long-term commitments.

In some cases, real-world activities do not demonstrate any meaningful shifts in business models across the global selection of companies.

The network includes some of Australia’s largest institutional investors who collaborate on engagement campaigns with the companies. The aim is to improve the companies’ long-term risk profiles, in the hope of protecting the investment performance of super funds (pensions funds) and insurance companies.

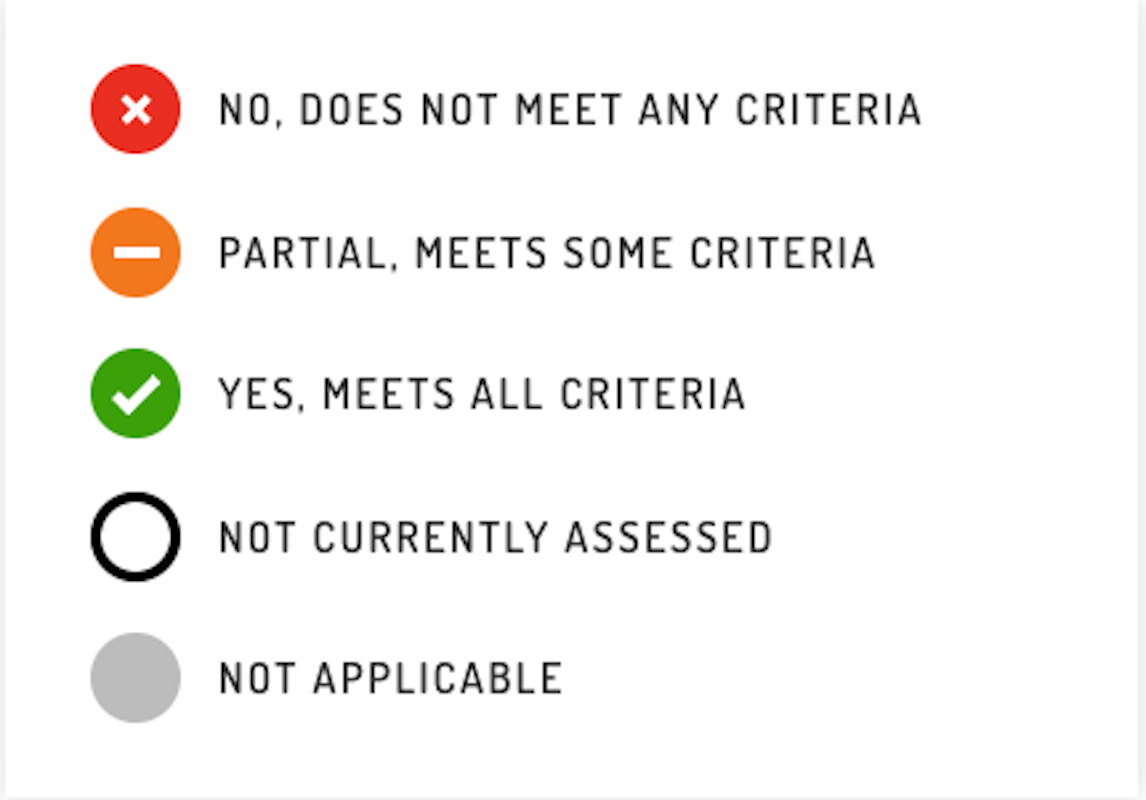

The ‘Net Zero Benchmark Alignment Assessments’ offer a useful overview of company status through use of a consistent set of ‘traffic light’ scores.

The assessment uses three engagement goals and a set of key indicators related to progress towards the goals of the Paris Agreement

“Through Climate Action 100+, investors have helped many heavy emitting companies make progress on transitioning to net zero but, as these assessments show, that progress needs to accelerate.” says Andrew Gray, Director, ESG and Stewardship at AustralianSuper and current chair of the global Climate Action 100+ Steering Committee.

“Companies need credible strategies and capital expenditure plans to deliver on their net zero targets.”

Key results across the global group of companies include:

An absence of short and medium-term emissions reductions targets aligned with limiting warming to 1.5°C.

Whilst 82% of focus companies have set medium-term targets, only 20% have established ambitious medium-term targets that cover all material scopes and are aligned with a 1.5°C pathway.

Scope 3 emissions remain absent.

Only half (51%) of focus companies have comprehensive commitments for net zero by 2050 or sooner that cover all material GHG emissions, including material Scope 3 emissions.

Australian Industrial Performance, or Lack-of

When the data-base of 159 companies is filtered to Australia only, you’re left with a list of 15 local companies:

- Adbri

- AGL Energy

- BHP

- Bluescope

- Boral

- Incitec Pivot

- Oil Search

- Orica

- Origin Energy

- QANTAS

- Rio Tinto

- Santos

- South32

- Woodside Petroleum

- Woolworths Group

As an example, we can look at results for AGL Energy, which has made headlines this year when Mike Cannon-Brooks emerged as an activist investor, suggesting new management was needed to make the company viable in the long term.

While AGL has set an ‘ambitious’ target to achieve net zero by 2050, it doesn’t include specific guidance about interim targets, or its immediate plans to reduce emissions towards 2035:

Rebecca Mikula-Wright is CEO of AIGCC and IGCC, and current vice-chair of the global Steering Committee, she says investors have done the hard work to drive commitments to targets, but now they need to see tangible action.

“Companies are making net zero commitments, but investors want those companies to turn intentions into concrete short- and medium-term actions to provide the confidence they can get to net zero.” she says.

“Corporate leaders can and should use each new round of Climate Action 100+ assessments to demonstrate their ambitious climate action.”