New gas projects may struggle to attract capital under 1.5°C, Paris-aligned climate scenarios, according to a new study by the Investor Group on Climate Change (IGCC).

The report, Changing Pathways for Australian Gas, examines the economic impact that keeping warming inline with 1.5°C targets will have on the gas sector. It recognises that a rapid energy transition poses risks to emissions intensive industries.

Modeling was done by global energy consultancy Wood Mackenzie, and tests the cashflow resilience of key gas projects that have either been recently launched or proposed.

“This modeling clearly points to a range of complex and interconnected risks that new gas projects face, and investors will be concerned about this.” Says Rebecca Mikula Wright, IGCC CEO.

“Overall, investors want to understand how Australian gas companies are assessing the risks associated with new projects, in particular the risk of accelerated demand decline as the world shifts to net-zero.”

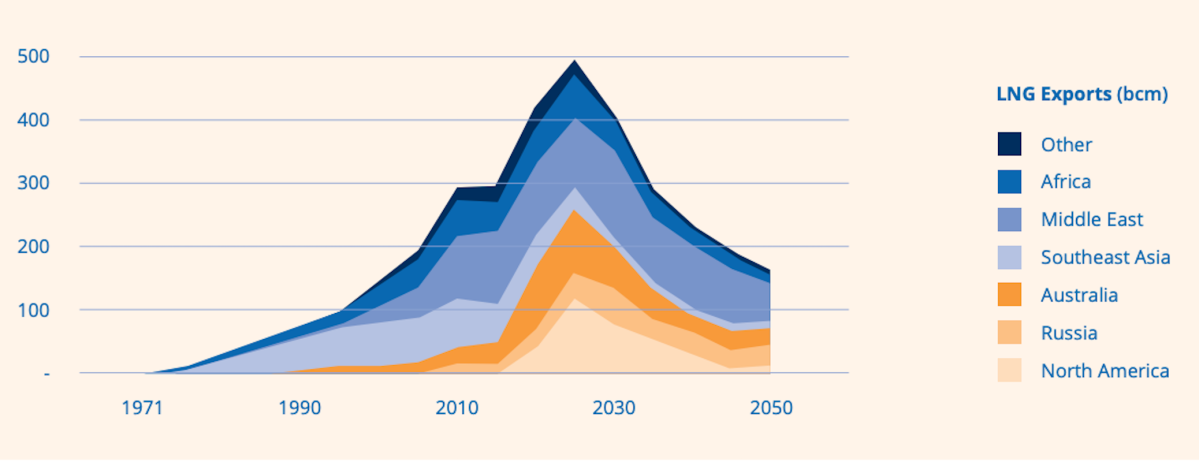

The core finding was that projects serving the export market would struggle due to higher overall costs than offshore competitors; noting three quarters of Australian gas is exported.

Challenges included high capital expenditure requirements and challenging geographies. As well as doubts that gas demand will remain steady, or grow, in coming decades.

The research shows that new gas projects face a risky future that is ultimately dependent on the pace of change for policy and technology.

“As an industry, gas companies need to develop and implement business strategies that will enable them to thrive in a zero-carbon world, and they need to do that now.” Rebecca Says.

“As a country, we need to be part of a net-zero emissions future by embracing a transition that is efficient, economically sensible, and favours renewable energy sources over fossil fuels.”

The IGCC’s membership base hold more than $33 trillion in global AUM, and the report includes input from super funds and other institutional investors that represent more than 7.5 million Australians.

Sign up HERE, to receive our weekly newsletter, and stay up to date with the latest impact news.