Despite a domestic and global focus on waste, Australia is failing to meet its rapidly approaching waste targets. Australians generate an estimated 75.8 mega tonnes of waste a year, which is equivalent to the weight of 471 Sydney Opera Houses. The average waste generated per person has increased 3% since 2017 despite a national target to reduce total waste generated by 10% per person by 2030. As our population grows, these figures are likely to continue to grow.

Why is waste an issue?

Waste includes everything from food and organics, paper and cardboard, metals, textiles, building and demolition materials, and plastics. Improper waste disposal is a pervasive issue because of its wide-spread impacts on ecosystems, waterways, soil, and health outcomes.

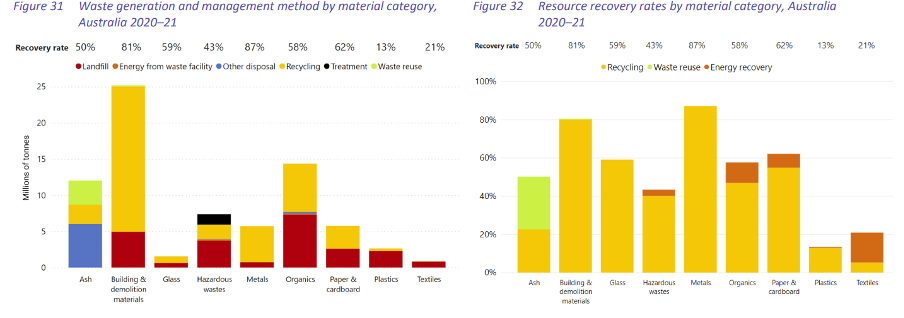

While most of Australia’s waste comes from the commercial/industrial and construction/demolition industries, the recovery rates of waste material from these sectors are much higher than that of households. Around 20% of all waste is municipal solid waste (MSW) generated by households and local governments but this only represents 13% of all recovered material. The majority of waste from households and local governments is food and organics waste. Australia creates more than 7.6m tonnes of food waste annually, which is enough to fill the Melbourne Cricket Ground nine times over. This not only costs the economy over $35bn, but contributes an estimated 3% of our greenhouse gas emissions.

National Waste Report 2022

Plastic is a significant contributor to the problem

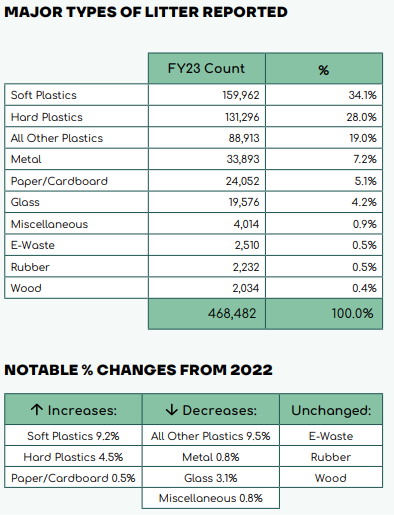

Plastic materials only contribute 3% of waste accumulated each year in Australia, but are one of the least recycled and recovered materials, and are found extensively throughout the environment. Plastic consumption has quadrupled globally in the last 30 years, and plastic pollution is expected to triple by 2040. Additionally, plastics account for over 3% of global greenhouse gas emissions.

While plastic has benefits such as providing a lightweight and cost-effective option for packaging and helping preserve food and reduce food waste, the amount of wasted plastic has a detrimental impact on the environment. Globally only 9% of plastic pollution is recycled while over half goes to landfill and a third of all plastic ends up in nature, where the equivalent of 2000 garbage trucks full of plastics is dumped daily into oceans, rivers and lakes. As a consequence, marine animals find themselves ingesting, entrapped in or injured by plastic debris, which has resulted in an estimated 100,000 animals being killed each year. As plastics breakdown in the environment through UV radiation, wind and ocean currents, they become small particles known as microplastics (smaller than 5mm) and nanoplastics (smaller than 100mm). The size of these plastics means they become easier for humans and animals to ingest accidentally. A study from the University of Newcastle found that the average person could be ingesting the equivalent of one credit card worth of plastic per week, and the presence of nanoplastics have been detected in human breast milk and placentas in healthy mothers.

Estimated microplastics ingested through consumption of common foods and beverages (particles (0-1mm) per week):

How does Australia compare?

Australia currently recycles and recovers just 63% of waste, a figure that has hardly changed in the last 7 years, despite having a national waste target of 80% resource recovery by 2030. In comparison, Singapore recovers 96% of waste, while Norway recovers 74%. With regards to MSW, Australia recovers just 42%, significantly tailing Germany at 67% and Switzerland at 53%. If we were to meet our 80% resource recovery target, an extra 15 million tonnes of material could be recovered each year for further use.

How can we help solve the waste and plastics issue?

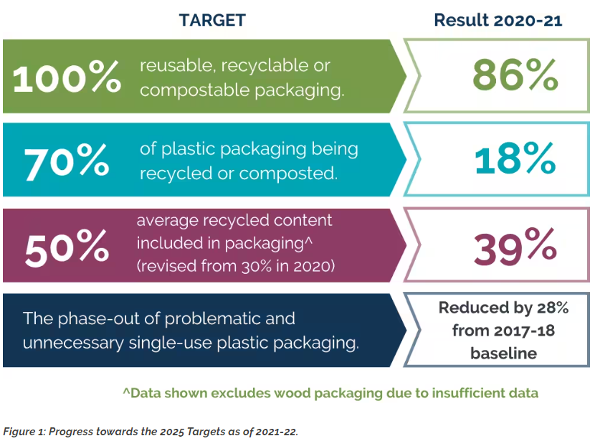

The biggest hurdle to meeting our targets is plastics, which is the least recovered resource by a significant margin. Given 40% of global plastic pollution comes from packaging alone, a key area for reduction of plastic usage and waste is packaging content. The Australian Packaging Covenants Organisation (APCO), a voluntary organisation, was established to help develop a circular economy for packaging in Australia. Over 2,300 organisations, including 50 of the ASX300 have signed up to APCO’s 2025 National Packaging Targets.

However, with less than 24 months to go until the deadline, Australia has failed to achieve any of the four targets. A key barrier to achieving the APCO targets is a lack of coordinated effort and strategy between governments, industry bodies and companies to collect and process waste.

Waste needs to be collected from households, councils and companies, sorted into different waste streams, directed to individual recycling and processing plants for each stream, and then subsequently developed into new recycled content for further use, preferably with the support of government legislation and funding, This is beyond the scope of any one company or sector and Australia currently lacks the required infrastructure to sort and process waste into new recycled content at a scale that is required to meet the targets.

What are some current initiatives to fix the problem?

In the wake of the collapse of the REDcycle program in 2022, the Soft Plastics Taskforce was created with Coles, Woolworths, and Aldi to reintroduce soft plastics collection in Australian supermarkets, and to engage with recyclers, processors, and industry groups such as APCO and the Australian Food and Grocery Council (AFGC) to determine Australia’s future recycling capacity for plastics.

The AFGC’s National Plastics Recycling scheme was created in order to develop a circular plastics loop, which will be financially supported with a levy by food and grocery manufacturers and aim to collect, sort, process and recycle soft plastics for reuse.

Currently, the scheme is focused on collection of plastics and has started trials in selected councils to educate consumers and improve current collection methods, with the aim to expand further into the recycling chain.

However, without sufficient funding and infrastructure, it is unlikely a comprehensive solution will be found soon. Current funding estimates for collection alone are $180m, plus the additional costs to develop infrastructure to sort and process the waste. In comparison, the Federal Government has committed a $250m commitment to the recycling modernisation fund in 2023.

A potential solution is the adoption of Extended Producer Responsibility (ERP). ERP is currently seen throughout Europe as part of the EU Packaging and Packaging Waste Directive, and requires the producers, importers and sellers of products to be responsible for a product’s entire lifecycle and meet certain recycled packaging content mandates. Under this scheme, the producer or a group of producers set up systems to collect waste packaging from the consumer and invest in solutions to reuse, recycle, or dispose of waste. Producers are responsible for covering all associated costs of collection, recycling and recovery, sorting waste streams, and building consumer awareness. One method of funding costs is ecomodulation, whereby each producer is charged a fee for the waste it produces by volume and material type and harder to recycle materials attract a higher fee. This provides an incentive for producers to develop and use the most environmentally and cost-efficient material in their products.

The EU has also recently drafted rules whereby cosmetics and medicine companies must bear at least 80% of extra costs to remove tiny pollutants from urban wastewater. This shows that companies in Australia and globally may find themselves wearing the financial burden of cleaning up waste if a more proactive approach is not adopted soon.

Melior Response

Melior seeks to invest in companies that contribute to the Sustainable Development Goals (SDGs). The issue of waste and importance of waste management is connected to several SDGs including SDG 6 Clean water and sanitation, SDG 11 Sustainable cities and communities , SDG 12 Responsible consumption and production and SDG 14 Life below water.

Examples of current holdings (as at Feb 24) helping to address the waste issue are Cleanaway (CWY) and Sims Limited (SGM). CWY is Australia’s largest waste management solutions provider, which collects, processes, treats, recycles and disposes of all waste types to help manage and reduce waste generation. SGM has 100 years’ recycling experience. It is a global leader in metal recycling with a comprehensive service for end-of-life and redundant electronic equipment and IT assets, as well as municipal recycling and developing new technology to advance the circular economy.

Melior also considers the waste issue in its company ESG assessment framework and tracks whether a company has a waste policy as well as quantified waste reduction targets and strategies in place. As part of our Quarterly Impact Pathway KPIs, we track the percentage of companies in our portfolio and across the ASX300 that have implemented waste reduction targets in their operations. As of 31 December 2023, 41% of our portfolio companies have a waste reduction target, compared to 22% of the ASX 300.

To publicly support the development of an effective global treaty to end plastic pollution and stay up to date with global developments, Melior has also joined the Business Coalition for a Global Plastic Treaty, which was assembled by the Ellen MacArthur Foundation and WWF International and brings together businesses, financial institutions, and NGOs who support the treaty and are focused on helping contribute to solving the plastic pollution problem.

Melior at Impact Investment Summit Asia Pacific

For those of you heading to the upcoming Impact Investment Summit in Sydney, Melior Investment Management Portfolio Manager Carlos Castillo will be discussing more on this topic in the Breakout session: “Eliminating Waste, Maximizing Impact – Resource Reuse for Environmental Gain.”

For more on Melior see https://meliorim.com.au/, and click here to see the full list of sources for this piece.