Contributor Adam Miller is an investor, a student, and aiming to have a positive impact.

I recently invested in the pre-series A round of a Ugandan fintech company called Asaak, alongside my friends Sachin and Max.

You might think I’m crazy, right? A combination of Africa, pre-series A investing and the fintech industry, would be enough to scare off most investors, let alone fledgling investors like us.

Whilst all early stage investing is risky, we didn’t blindfold ourselves and throw darts on a board. We made a considered bet that there’s significant potential in Africa for a thriving fintech industry and that the industry can have profound social impact on people.

This article will shed light on that thesis, and it will accompany our deal memo to Asaak.

It’s not investment advise, it’s just our research and our approach.

Why Africa?

While many African nations are at a ‘developing’ stage, there is an enormous amount of growth ahead for the continent, which is raising the bar for opportunities. This growth can clearly be seen in terms of population, money and connectivity.

Population

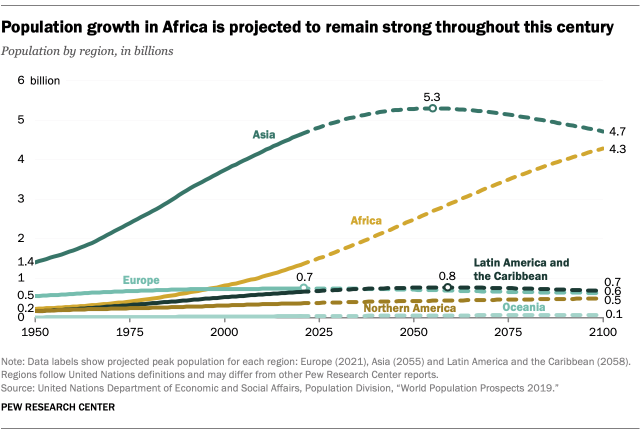

Currently standing at 1.2 billion people, the African continent’s population is set to double by 2050 to 2.4 billion, off the back of high birth rates. In a world where developed nations are seeing declining birth rates and ageing populations, this growth has profound implications. It means that in 30 years time, Africa will represent 25% of the world’s population and make up a huge chunk of the world’s working age population.

If nothing else changes, and this population growth persists, Africa will see its relevance in the global economy almost double in 30 years time. At this point, we will see mass population centres in countries like Nigeria, with over 400 million people, and the Democratic Republic of Congo, with nearly 200 million people.

Money

In just 10 years time, we will see Africa’s combined upper and middle class reach an enormous 600 million people. This is almost double the size of the USA’s current population, presenting a huge set of future consumers.

Whilst African purchasing power is not as significant as the US, the continent’s people are set to contribute to over $2.5 trillion of consumer spending by 2030. This will create a mass influx of spending into consumer businesses, which makes the area much more attractive to receive VC funding.

The TLDR: African nations populations and incomes are growing fast which creates a more attractive market for entrepreneurs and investors.

Note: When talking about Africa, I am talking specifically about Sub-Saharan Africa.

Why Fintech?

Fintech is the dominant component of Africa’s startup scene for good reason. The innovations are responding to a number of problems in the area.

Cash

Most Sub-Saharan countries still pay for goods predominantly in cash. Nigeria, at the largest scale of 200m people, have a majority of their population paying with cash, and Kenya, at the more extreme end, has over 90% of retail transactions in cash. This creates problems like corruption, fraud and theft, and leads to around 5-7% of GDP being spent to clean and process the cash. In poorer nations where capital is constrained and economic development highly valuable, this money is sorely missed.

Banks

Most of Africa is seriously underbanked. Take Nigeria again. It’s 200 million people have access to 23 different types of banks, which may sound like a reasonable number. But those 23 banks only have 5,000 bank branches which has led to just 36% of Nigerians having a bank account. This severely constrains the savings of the region. If you paid attention to your high school economics, you’ll know that lower savings leads to lower investment.

Fintech solutions

These problems offer fertile ground for disruptive fintechs.

Why build out fintechs instead of focusing on basic infrastructure like physical banks and standard credit cards? Connectivity is the answer.

As one part of the region’s demographic trends, African’s are becoming increasingly connected. Nearly 50% of Sub-Sahran Africans have a mobile device, which is nearly 500m people, and it’s estimated in 5 years that 85% of people could have a SIM connection. A more connected population is allowing for increasingly innovative, mobile-led solutions in spaces like payments, banking and remittances. This means that Africa can leapfrog previous layers of innovation.

Here are examples of the African fintech companies leading the way:

- M-Pesa (Kenya)

- Mobile money P2P payment system developed in 2007 by Safaricom

- This became one of the first popular fintech solutions worldwide and is now used by over 72% of Kenya’s population

- Interswitch (Nigeria)

- Transaction processing and card network business

- Valued at over $1 billion from a 2019 investment from Visa

- Flutterwave (Nigeria)

- Started in 2016, the YC backed company provides software and hardware that allows you to make and accept payments. It has processed over $2b in payments and 25 million transactions

- Tiger led a 170m round in 2021

- Paystack (Nigeria)

- API based payment services

- Acquired by Stripe in 2020 for $200m+

- Tymebank (South Africa)

- South Africa’s first digital bank

- Secured over $100m of investment this year

Impact Profiles

Investing in African fintech has significant potential for wide-scale social impact.

Here’s the impact that some of the business models are creating

Digital Banks: Asaak

Digital banks like Asaak are providing credit where it’s missings. Asaak currently provides loans for critical products like motorcycles, mobile phones and gas.

This is of crucial importance as many people in Sub-Saharan Africa can’t afford these goods outright. In fact, in Uganda the average Boda driver (motorcycle taxi) spends 50% of their income on renting out the motorbikes.

Through offering the most competitive interest rates in the country, Asaak gives people the opportunity to own the goods they need for their jobs. This allows for greater employment levels and a reduction of poverty as people achieve higher disposable incomes.

P2P money systems: M-Pesa

M-Pesa is the renowned peer-to-peer mobile money system that originated in Kenya. They allow quicker, cheaper and more reliable money transfers over greater distances.

Before M-Pesa, payment transaction costs were extremely high in Kenya and banks were few. Most people had to walk, on average, 9.2 kilometres just to visit a bank branch. This meant that people were confined to primitive payment methods that were costly.

The introduction of M-Pesa has allowed people and businesses to pay better and it has also provided greater financial infrastructure, as in 2015 the average distance to the nearest M-Pesa agent for a Kenyan was just 1.4km.

This has contributed to the improvement of financial behaviours, as it has facilitated easier and safer savings. The effects are so profound that A recent study has shown that the expansion of mobile money has lifted 194,000 Kenyans out of extreme poverty and it has enabled 185,000 women to move out of subsistence farming and into business or sales occupations. This leads to substantial increases in economic growth and poverty alleviation.

E-commerce and payment processing: Flutterwave

Flutterwave enables payment processing and has created an e-commerce platform to enable small businesses to set up their shops online, with payments and delivery integrated.

They’re having large-scale impact across Nigeria as their e-commerce platform has enabled businesses during Covid to continue trading, even when they can’t trade physically. This is extremely important as up to 90% of Sub-Saharan businesses are SME’s. Without this service, many more SME owners would be plunged into poverty as they would have to halt their business operations.

Furthermore, Flutterwave provides API’s which allows merchants to take any form of payment transaction, instead of having to open up multiple accounts to accept different types of payments. This reduces fees for merchants and contributes to increased economic activity.

Following the Chinese Playbook

Whilst normally economies transition like this:

- cash → physical banks → credit cards → contactless, digital first solutions

We may see Africa go more like this:

- cash → contactless, digital first solutions

If you think this is a pipedream, It isn’t. It’s a playbook.

What happened in China

Currently, over 85% of payments transacted in China happen through QR codes in a completely contactless way. But just in 2010, QR code payments were virtually 0% and the vast majority of payments were being transacted in cash. They nearly completely skipped over the credit card phase. So why did this happen?

For three reasons:

- Chinese merchants didn’t like card-based payment terminals because of the large merchant fees. We have to remember that in 2010, China’s GDP per capita was less than half of its size now, so those relatively small fees meant a lot to them now.

- Card readers required a wired telephonic system or a wireless system to communicate, which many merchants didn’t have. To embed innovative technologies into a society, it is often required that you have preceding layers of technology at low-cost and in an accessible way.

- BUT, at the same time smartphone penetration was growing at a staggering pace. Penetration grew from 6% in 2010 to 68% in 2015.

Together, this unique composition of factors created an environment that was ripe to leap ahead in financial infrastructure, and move straight to a digital and contactless system. Innovation does not always need to be linear. Africa can follow this.

Show me the money

To make a bet on African fintech you want to see smart money travelling in the right direction.

The good news is that African VC funding has gone from practically $0 ten years ago to $1.43 billion as of 2020. Whilst this is only a slice of the pie of worldwide funding at just 0.5%, it’s growing at an extremely quick pace of over 40% per annum since 2015.

Funding by country is extremely unequal. Nigeria, Kenya, Egypt and South Africa represent a staggering 80% of funding, and that’s out of 54 countries.

This rise in funding has come significantly from international VC’s like TPG, GE Ventures, Softbank, Sequia, Goldman Sachs and Accel. Attracting international capital is an extremely good sign. Though the ecosystem still has a long way to go as 50-70% funds under management in all the VC and PE funds come from development based organistions like the International Finance Corporation.

With the growing headwinds, and over $20b of revenue moving through the African electronic payments industry in 2019, this is becoming an increasingly attractive landscape for VC’s.

Risks and challenges

It would be irresponsible and naive not to touch on the risks and challenges within the African fintech ecosystem.

Some risks include:

- Financial Services in Africa is heavily dominated by telecommunications companies and traditional banks which engage in heavy government lobbying

- Many nations in Africa are mired by political instability

- Expansion from Africa to the developed world is difficult due to cultural barriers

- There’s a lot of consumers but incomes are still relatively very low compared to developed nations

Whenever there is an area that promises strong growth, it’s always going to be met with risk and challenges. There is no doubt that as a whole Africa is going to get much much richer and larger over the next decade, but specific bets have to be placed with a lot of research.

References

https://global.chinadaily.com.cn/a/202102/02/WS6018c23ea31024ad0baa6b4c.html

https://www.brookings.edu/wp-content/uploads/2020/04/FP_20200427_china_digital_payments_klein.pdf