Blended finance is an approach that uses more than one source of finance and funding to enable a transaction that achieves a positive social or environmental outcome. It is often applied in development projects but it can be extended into developed countries, such as Australia.

Blended finance brings five different finance ‘buckets’ together and seeks to meet the various risk, return and impact objectives and legal and investment horizon requirements of each form of investor through a layered or collaborative approach to financing. For example, they may require exit opportunities at particular times, or alternatively, they may have longer-term time horizons. Each source of finance is used to play to its strengths. Impact investing can sometimes be the glue in these transactions.

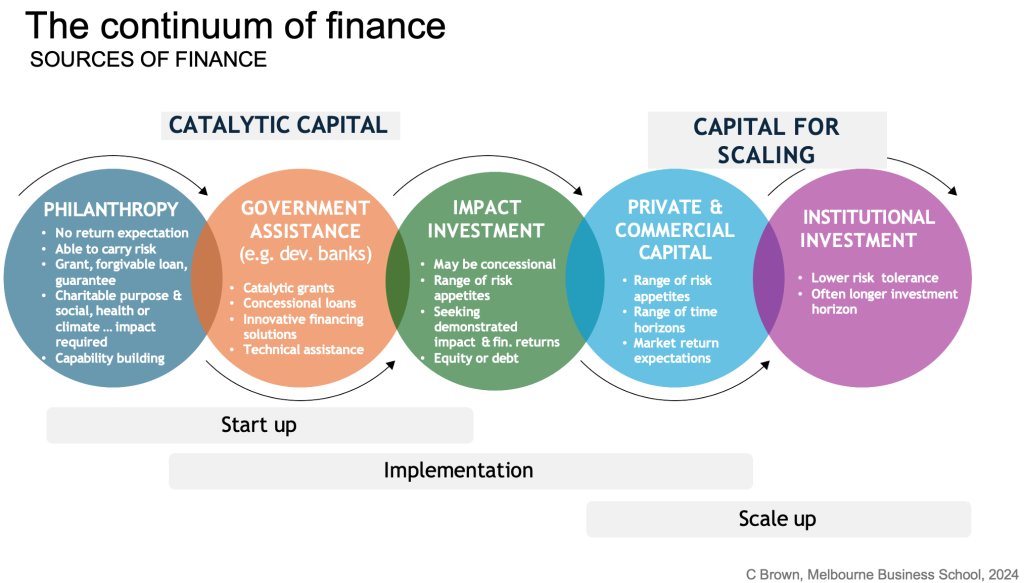

First, let’s look at the five sources of finance. The diagram below helps explain blended finance as a concept. Some of these sources are impact focused, some are concessionary and some are not. Blended finance usually includes a catalytic source or sources of finance that kick start the capital stack or the project development.

Scaling up finance comes into play as the transaction or project becomes attractive to long-term, more risk-averse private or institutional investors. Investors use many tools, including debt, market returns and concessional debt, grants (recoverable and philanthropic), guarantees, equity, and other innovative financing structures. The catalytic investors, often concessional lenders or grantmakers, are essential to getting the transaction started.

Each of the sources of finance has different drivers. Philanthropic grants do not require a financial return but the funder usually wants the grant to make a positive social or environmental impact (and be for a charitable purpose at law). Philanthropy can be a first mover and an important piece in the capital stack or provide support for important early research and model testing. Specialist government vehicles, such as the Clean Energy Finance Corporation, use a range of grants and investment approaches to support our transition to renewable energy. They can be first movers.

Private capital requires financial returns and can have a greater risk appetite or be able to reduce risk due to investment expertise in a particular industry (e.g. long experience in clean technology). Institutional investors often require lower risk and a proven track record but can have a long investment time horizon. Impact investment is an important player in this mix. Some impact investors provide concessional finance, some require market returns and some take different approaches depending on the transaction. Their risk appetite also varies. Most importantly, impact investment is driven by impact alongside achieving a financial return.

In my role as Enterprise Professor at the Melbourne Business School, I have been bringing together representatives from various sources of finance with the aim of increasing finance for Australia’s and our region’s climate transition. This includes a series of deep dive roundtables under Chatham House Rules and the creation of a website to hold roundtable reports, external reports and blended finance case studies. Many of the case studies were presented at the roundtables. I am pleased that other investors are indicating interest in providing more case studies.

The case studies include overviews of major transactions, such as one led by the Asian Development Bank to build an enormous windfarm on Laos, Macquarie Asset Management’s involvement in financing the transition to electric buses in India, and the Clean Energy Finance Corporation’s leadership on a major wind farm in Victoria. They also include initiatives in climate technology by Grok Ventures, smaller scale investments in regenerative agriculture by Good Business Foundation and the creation of a Transition Accelerator by Trawalla Foundation, and more. This demonstrates that leadership can come from any source of finance: philanthropy, specialist government vehicles, impact investment, private capital and institutional investment.

Blended finance has a very important role to play in our climate transition. This was highlighted in the last Intergovernmental Panel on Climate Change report:

There is sufficient global capital and liquidity to close global investment gaps, given the size of the global financial system, but there are barriers to redirect capital to climate action … (high confidence). For shifts in private finance, options include better assessment of climate-related risks and investment opportunities within the financial system, reducing sectoral and regional mismatches between available capital and investment needs, improving the risk-return profiles of climate investments, and developing institutional capacities and local capital markets… (high confidence).

Near Term Responses in a Changing Climate. Intergovernmental Panel on Climate Change (2023), AR6 Synthesis Report, p.111

My first direct experience of blended finance began in relation to environmentally sustainable affordable housing, delivered through a community housing model that supports residents and builds links with community. An initial grant of $1 million from the Lord Mayor’s Charitable Foundation (where I was CEO), leveraged well located land in the Melbourne suburb of Preston (owned by the City of Darebin and valued at over $3 million), and enabled Housing Choices Australia (after a tender process) to build the project through Big Housing Build government funding from Homes Victoria and private debt through its own commercial bank. This housing is now complete and home to 39 residents. It is energy efficient, climate safe and located close to public transport, shops, services and green space.

To select the best site partner, we used a tool developed by our partners at the School of Design, University of Melbourne, known as the Housing Access Rating Tool (HART). This project took five years to complete.

Townhall Avenue community housing project (Tom Roe Photography).

Sharing case studies via the MBS Blended Finance for Climate Initiative helps reduce the time it takes to shepherd projects from start up through to scaling up. By sharing successful projects, I hope to accelerate confidence and expertise in blended finance approaches across the sources of finance.

As a former Social Impact Investing Taskforce member and as a Board member of IIA, I encourage impact investors to accelerate the use of blended finance approaches and to think outside the box about how to finance alongside philanthropy, specialist government investment vehicles, private capital (not impact first) and institutional investors. There are exciting developments taking place, and by sharing knowledge, we can help accelerate this progress. The leverage power of impact investing can be immense.

This story is part of an ongoing series curated by Impact Investing Australia (IIA) designed to explore impact investing and related concepts. IIA is growing the market for investments that deliver measurable social and environmental benefits alongside financial returns. Our vision is that every dollar invested builds a better world.