GSG Impact’s latest report, Towards Impact Economies: Aligning government action and private capital for public good, sets out a practical roadmap for governments to bridge financing gaps and deliver on national priorities by embedding social and environmental impact into every economic decision.

The report argues that governments are uniquely placed to unlock the trillions of dollars in private capital needed to tackle social and environmental challenges. By rethinking how they spend, regulate and build markets, policymakers can help drive impact economies – systems where impact sits at the core of public policy, business and investment.

As GSG Impact’s Australian National Partner, Impact Investing Australiacontributed insights and case studies, demonstrating how policy initiatives here are supporting the development of an impact economy.

Policy: The key lever for change

According to CEO of GSG Impact, Elizabeth Boggs Davidsen, policy is the lever that can embed impact into every investment, business and government decision. “With our community of National Partners across 48 countries, we stand ready to support policymakers and public actors to build economic systems that put impact at their core,” Elizabeth said.

The report notes that while private capital exists in abundance, governments must create the conditions for it to flow with urgency, scale and integrity into opportunities that deliver both financial returns and measurable impact. By aligning incentives and regulation with social and environmental goals, governments can stretch limited budgets, reduce fiscal pressure and deliver more value for its citizens.

A policymaker’s toolkit

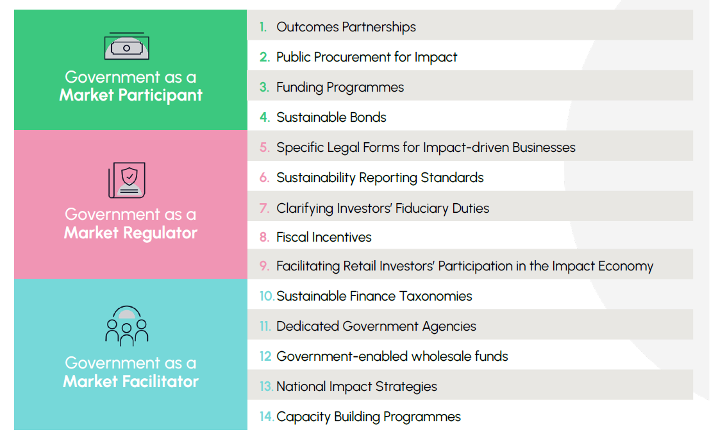

The report serves as a policymaker’s toolkit, identifying 14 practical tools that governments can use to catalyse impact economies. These are grouped under three roles:

- Market Participant – Spending and investing for outcomes

- Market Regulator – Setting rules that price in impact

- Market Facilitator – Building the market’s infrastructure

Each role is illustrated through global examples, including several from Australia that highlight how national and state governments are already advancing impact-driven policies.

1. Government as a Market Participant

As market participants, governments can directly drive impact through how they spend and invest – shifting from funding activities to commissioning for measurable outcomes.

The Victorian Government’s Social Procurement Framework (SPF), introduced in 2018, was Australia’s first whole-of-government policy to embed social and environmental objectives into procurement. The framework requires departments and agencies to consider inclusive employment, supplier diversity and sustainability in purchasing decisions. Its success has since inspired similar initiatives in Western Australia and New South Wales.

Australian Development Investments (formerly the Emerging Markets Impact Investment Fund), launched by the Department of Foreign Affairs and Trade in 2020, provides another example. By blending public and private capital, it channels investment into early and growth-stage businesses in emerging markets that deliver measurable development outcomes. According to its first impact study, Australian Development Investments has mobilised more than $5 in private investment for every dollar of public capital.

The report also highlights the strong uptake of voluntary certification schemes, such as B Corp. While Australia has no specific legal structure for social enterprises, the rapid growth of B Corp certification across Australia and New Zealand has helped create a recognised market signal for impact-driven businesses.

2. Government as a Market Regulator

As regulators, governments can create the enabling conditions for impact by embedding transparency and accountability into financial markets.

The Australian Sustainability Reporting Standards (ASRS), developed by the Australian Accounting Standards Board (AASB), are a key step in this direction. Part of the Federal Government’s Sustainable Finance Strategy, the standards align with international IFRS S1 and S2 frameworks and will phase in from 2025. They are designed to improve consistency in sustainability reporting, giving investors reliable data to assess climate and social performance.

Pricing sustainability into corporate reporting helps direct capital towards projects and businesses that deliver measurable environmental and social outcomes – a defining feature of an impact economy.

3. Government as a Market Facilitator

The third role outlined in the report is market facilitator – where government strengthens the ecosystem for impact by supporting capability, infrastructure and knowledge sharing.

Australia’s Social Enterprise Development Initiative (SEDI), announced in the 2023–24 Federal Budget and administered by Impact Investing Australia, illustrates this role. The $11.6 million program has supported social enterprises that assist vulnerable communities, including First Nations peoples and those in regional and remote areas. SEDI Grants fund organisational capacity in areas such as business planning, financial management and impact measurement. The grants are complemented by the national mentoring and education program coordinated by Social Enterprise Australia through its Understorey platform.

By investing in sector-wide capability, SEDI demonstrates how governments can nurture the foundations for sustainable, impact-driven growth.

The Australian opportunity

While Australia is making progress, there is potential for stronger government leadership to expand and coordinate impact-focused policy efforts.

“The GSG Impact report is a timely reminder that governments have powerful levers to shape markets for social and environmental good,” said David Hetherington, CEO of Impact Investing Australia.

“Australia has made encouraging progress, but there is a real opportunity for both federal and state governments to take a more active role as market participants, regulators and facilitators. By embedding impact into public investment, regulation and market-building efforts, we can mobilise much greater private capital towards the priorities that matter most to Australians – from housing and health to regional and environmental resilience.”

A shared global mission

The updated report builds on six years of global learning since its original release in 2019, providing evidence of which policies are proving most effective in practice. Across its 48-country network, GSG Impact sees governments rethinking regulation, piloting innovative financing mechanisms and embedding impact into national strategies – even amidst fiscal constraints and uncertainty.

The message is clear: governments have a defining role in building economies that deliver social and environmental value alongside financial return – not as a niche activity, but as a new norm for sustainable growth.

About GSG Impact: GSG Impact builds impact economies – systems where social and environmental impact is at the heart of every political, investment, business and consumption decision. Through its 43 National Partners across 48 countries, GSG Impact connects governments, investors, regulators and social innovators to create the infrastructure and incentives that drive social and environmental progress. More than half of its partners operate in emerging markets, collectively representing two-thirds of the world’s population.

Impact Investing Australia is GSG Impact’s Australian National Partner and is proud to have contributed Australian insights and case studies to the report.

This story is part of an ongoing series curated by Impact Investing Australia (IIA) designed to explore impact investing and related concepts. IIA is growing the market for investments that deliver measurable social and environmental benefits alongside financial returns. Our vision is that every dollar invested builds a better world.