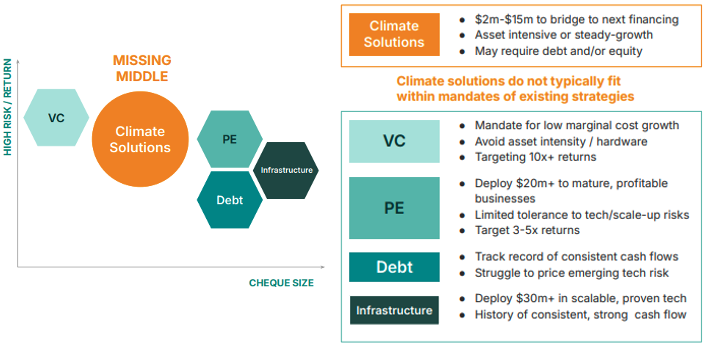

Traditional funding models like venture capital, private equity, infrastructure, and debt are often not fit for purpose when it comes to climate solution funding. This leaves a gap between the investment that climate solutions need and the funding available.

Ecotone Partners, led by Nicole Kleid-Small and Amanda Goodman, along with fellow partners Jeremy Burke and Daniel Madhavan, recognised that a new investment approach was needed — one specifically designed for climate solutions that can deliver outsized impact alongside outsized returns.

Ecotone recently launched the Planet Fund to invest in transformational, ready to scale, climate solutions that have a clear path to profitability.

The fund will focus on companies with solutions that accelerate the decarbonisation of our economy, offer lower failure rates and faster time to commercial scale and to climate impact. With a mandate that encompasses both debt and equity investments, it is uniquely structured to deliver short term liquidity and longer term upside returns.

The Planet Fund has a focus on solutions that can impact emissions in the near term; have demonstrated and validated technology; are ready to commercialise and scale; have exceptional visionary founders; are at or near profitability; and can unlock significant growth with the right capital.

The fund will invest across all sectors and industries, and across different business models and technologies that help customers meet science-based decarbonisation targets.

Amanda, who was previously Head of Capital Raising at Impact Investment Group and Fund Manager at Giant Leap, explained, “We set up Ecotone Partners about 3.5 years ago to really double down on climate because that’s where we felt we could make the most impact.

“In the early days, the team did a lot of capital advisory work with companies in the climate space, helping them structure the type of capital they needed from investors and figure out how to get that capital.

“Our thesis around the Planet Fund has really been shaped by our experience in the market trying to match these companies with capital providers,” she said.

“Having spent a lot of time talking to those companies and investors, we learned that there was a fundamental problem when it comes to funding climate solutions.”

The climate finance missing middle

Amanda and Nicole, a former investment director for early-stage VC Rampersand, said there was a gap in the market, the climate finance missing middle — a mismatch between businesses that have developed technology proven climate solutions and the funding available.

“Typically, funds start with a very specific mandate and then they look for companies that fit that mandate. And, typically, climate businesses don’t fit within the mandates of the existing types of funds that are out there,” said Amanda.

“A lot of these businesses don’t fit the VC mandate because they’re not highly scalable and are very capital intensive. They’re too early for private equity and too small, and the same typically goes for private debt. But a lot of these companies are really good solid businesses, they just don’t fit the mould of what other funds are looking for.”

“And that’s the space that we want the Planet Fund to play in.”

Nicole added, “A lot of companies fall into the missing middle, which are businesses that have more asset intensive business models, and need access to the right kind of capital to scale.”

“These businesses have often proven their technology, have revenues and customers, have near term ability to reduce emissions but are missing the capital needed to scale commercially. While there might be some scale up period, ideally we want them to start decarbonising as soon as we invest.”

By focusing on ready to commercialise and scale technologies, the risk profile of the portfolio is lowered, accelerating the time to liquidity for the portfolio and lowering total carbon emissions.

Climate solutions tend to fall into the gap between VC, PE and debt.

Flexibility to tailor capital

Climate solutions often require both debt and equity funding, but coordinating and executing equity and debt capital raises with different providers is difficult, and can take time that could be better focused on solutions and business building.

The Planet Fund is looking to provide flexible capital to tailor capital to the needs of the company.

“We can invest debt and or equity and work with the company to understand what their funding needs are now and into the future, and design that tailored funding package to help them grow and bridge the gap to other sources of capital that might be more readily available down the road,” Amanda said.

“And because we’re unique in the market, we can access deal flow that others can’t fund, providing us with this sort of proprietary deal flow.”

A diversified portfolio to meet investor needs

The Planet Fund will have a diversified portfolio with the bulk of investments in secured private debt, where they can lend against these businesses’ asset bases or they have secure contracts the fund can lend against.

“On the equity side, we’re calling it pre-private equity. Businesses that have different business models than venture would look at and are smaller than private, but they’re private equity style businesses.

“We’ll have a focus on cash flows and profitability. And we’ll only invest in a business when we’re the last cheque in before profitability or when they’re already profitable. We don’t want to be investing in businesses that have to keep raising capital to survive.”

Other things Amanda and Nicole heard from a lot of investors was that they didn’t want to be locked up in long term structures, so Planet Fund was established as an evergreen fund.

Investors also valued cash generation, so the fund targets an annual cash yield. And they wanted a lower risk profile than venture.

“A lot of them had been deploying in venture but a lot of the anticipated exits just hadn’t been coming to fruition. They’re saying I’ve already got a lot of that kind of risk exposure, I don’t want more.”

The fund can also generate a cash yield because the debt investments will pay interest, and cash returns can be passed on to investors on an annual basis.

And as the majority of the portfolio will be in debt, they’ll also turn over more frequently. This means the average deal time will be shorter than your typical equity investments, and this organic liquidity within the portfolio will help support investor redemptions.

Not a typical VC, PE or Debt Fund

Amanda and Nicole state that Planet Fund is explicitly not a venture fund. Rather, it provides an investment approach distinct from traditional venture capital, private equity, or debt funds, offering bespoke funding solutions that address the capital needs of individual businesses and prices risk accordingly.

By capitalising on the structural changes driven by the climate transition, the fund aims to generate alpha returns derived from differentiated, proprietary deal flow.

The fund provides both dilutive and non-dilutive forms of capital, accelerates capital deployment to climate solutions, and supports founders in navigating through the funding “valleys of death”.

The fund aims to secure attractive risk-adjusted returns and an annual income yield, while delivering meaningful climate outcomes. The fund targets an initial portfolio of 4-8 companies, based on the minimum A$20 million in capital and is targeting a fund size of A$30 million for the First Close, which it hopes to reach by the end of the year.

Ecotone Partners intends for the Fund to scale through multiple subsequent capital raises in the medium term, as investor demand picks up and demand for flexible climate financing solutions grows.

The fund is structured as an evergreen fund, comprising approximately 60% structured debt and 40% “Pre-PE” equity, which diversifies risk and reduces volatility.

For more on the Planet Fund see https://www.ecotonepartners.com.au/planet-fund, or contact amanda@ecotonepartners.com.au or nicole@ecotonepartners.com.au.