In its just released Impact Report 2024: Celebrating ten years of mobilising capital for a better tomorrow, Australian Impact Investments (Aii) reflects on its ten years of providing impact asset consulting services, dispels myths and seeks to break down barriers.

Managing Director Kylie Charlton, who co-founded Aii in 2014, contends that the time is now ripe for impact investing in Australia to scale up.

“After ten successful years we are able to dispel some myths about impact investing and take on some persistent challenges,” said Charlton.

“Our track record over the last ten years shows that financial goals can be achieved simultaneously with social and environmental goals. Together with investors, we are transforming how capital is allocated to benefit people and the planet.”

Issues to address to unlock impact capital

While the impact investment sector has matured and become more well established in the last decade, Charlton highlighted the three areas that need to be addressed to unlock further capital for impact investing:

- Tackle greenwashing and impact washing – robust impact measurement and monitoring practices and standards need to be implemented to enable investors to distinguish between genuine impact and superficial claims. Measurement is key to informing better investment decisions and enabling capital to be directed to where it can make the most difference.

- Diversification across asset classes – while venture capital plays a crucial role in supporting early-stage impact businesses, it is essential that a range of investment instruments catering to the diverse requirements of investors are activated to drive deeper, system change and enable solutions for the big issues of climate change and social inequality.

- Wealth advisors and institutional investors need to embrace impact investing – with the growing body of performance data now available, citing concerns about performance and complexity is unacceptable. Wealth advisers and institutions, such as endowments and superannuation funds, need to lean in to navigating compelling opportunities that allow them to better serve their clients, members and broader stakeholders.

Unique investment opportunities

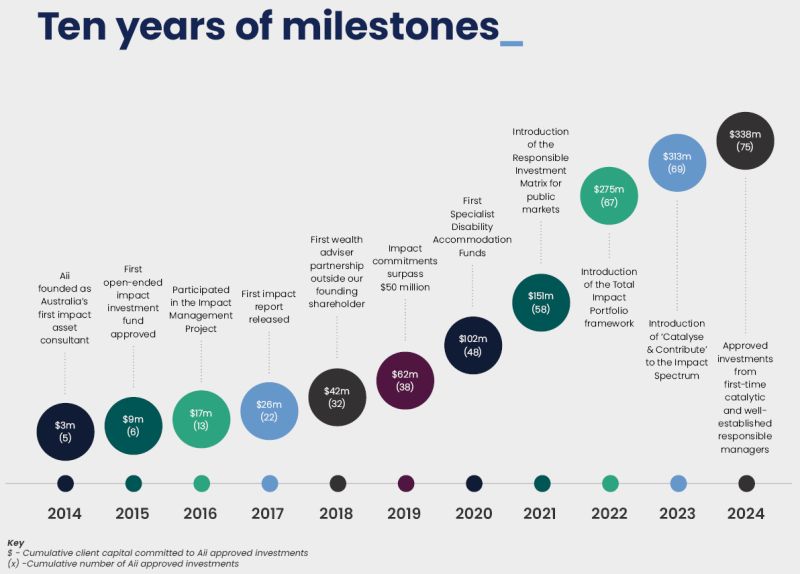

Over ten years of providing impact asset consulting services, Aii has facilitated 72 deals that have mobilised $325 million of capital.

The range of unique opportunities coordinated by Aii have delivered investors returns upward of 10% while delivering genuine social and environmental impact.

Charlton said, “Many conversations about impact investing start with concerns that ‘it sounds good in theory but we don’t want to sacrifice returns’.

“Our experience over the last ten years shows that you can invest for impact and generate competitive returns. We have concrete evidence from Australian investments across multiple asset classes, which show that it’s possible to invest for impact and generate risk-adjusted, market-rate returns.”

Aii deals have enabled outcomes that range from quality education for children living with autism, integration of Aboriginal knowledge seamlessly alongside the National curriculum, installation of solar on the Sydney International Convention Centre, and restoring children in out-of-home care to their families.

Examples include the success of the Infradebt and Ngutu College in Adelaide.

Infradebt

Aii has facilitated investments of $20 million into specialist infrastructure debt manager, Infradebt, to support mainly wind and solar power projects across Australia

Infradebt’s Infradebt Ethical Fund (IEF) — Australia’s first ethically screened private debt fund — is focused on infrastructure projects that make a positive and sustainable difference to society and deliver a superior risk-adjusted return.

This fund was initially set up for wholesale investors able to invest a minimum of $5 million. Aii worked with Infradebt to make the fund accessible to smaller scale investors by setting up a series of ‘feeder’ vehicles requiring a minimum commitment of $100,000.

Since 2018, Aii has facilitated almost $20 million of client capital into the feeder funds, or about 15% of funds that IEF has raised.

IEF has returned 6.4% since inception, a spread of 4.7% above its benchmark. The 1-year return to October 2024 was 8.2% (these returns are net of fees).

In January this year, Infradebt entered a strategic partnership with Australian Ethical to jointly develop a new wholesale fund – Australian Ethical Infrastructure Debt Fund (AEIDF).

Infradebt Investment Director Alex Ramsey said: “Since 2018, Aii clients have supported 44 infrastructure projects, including 12 wind projects and 24 solar projects representing 1,356 MW and 474 MW of capacity respectively – annually these projects deliver approximately 5,700 GWh of emissions free electricity to Australians.

“Aii clients are also playing an important role in supporting the rollout battery storage in Australia which is key to transitioning away from traditional baseload generators (gas and coal). Aii clients have also supported social infrastructure supporting schools, hospitals and community infrastructure.

“A key feature of Infradebt’s approach is designing fit for purpose lending structures for the projects we support, where each loan reflects the unique operating environment particular to the project.

“This is only made possible because of support from investors like Aii clients who are seeking both returns and diversification in their investment portfolios, but at the same time want to support and advance Australia’s environmental and social objectives.”

Ngutu College

Ngutu College in Adelaide is a unique school founded by educator Andrew Plastow with a vision to ‘redesign schooling to be genuinely equitable, culturally informed and authentically child centred’.

Ngutu has a goal of enrolling 50% First Nations students of a total 350 students across Kindergarten to Year 12 by 2026. Currently 48.6% of students are Aboriginal.

A $4.8 million Aii loan to set up the school is delivering up to 10% per annum interest on repayments to investors.

Ngutu College Board Chair Catherine Baldwin said, “We would not have been able to open without the financial support generated by Australian Impact Investments.

“They were prepared to take a risk on a vision and concept that didn’t yet exist. We had government backing, but needed bridging finance to set up the school before the government funding was available.

“Aii has syndicated $4.8 million loan capital from their clients, which covered the establishment costs, and the building of technical classrooms equipped for teaching science, maths, art and music.

“Aii were able to structure the loan to meet their client’s investment objectives while meeting our very specialised objectives. The loan has outcomes-linked interest rates so that if we reach our impact target of 50% aboriginal enrolment, the interest rate on our repayment decreases.

“The work that’s gone into developing the detailed financial modelling is phenomenal. It’s a real partnership.”

Total Impact Portfolio

Aii is also pioneering a new approach to investing called the Total Impact Portfolio. This approach incorporates impact objectives alongside financial objectives for investments across every asset class in an investment portfolio.

For instance, Aii has worked with the 138-year-old South Australian based charitable trust, the Wyatt Trust, and The Tony Foundation — the foundation of Alberts — to align their investment assets with their mission and purpose.

Aii has played a key role in shaping the broader impact investing ecosystem through thought leadership and involvement with initiatives like the Blueprint to Market, the Responsible Investment Association Australasia’s Benchmarking Impact Reports, and key global bodies such as the Impact Management Project.

Click here to access Australian Impact Investments’ Impact Report 2024.

Be sure to subscribe to the free OnImpact newsletter here, and follow us on LinkedIn.