After decades of business management and advisory experience, MAD Ventures founders have designed a unique investment structure that solves for investor liquidity and tackles the world’s most urgent challenges.

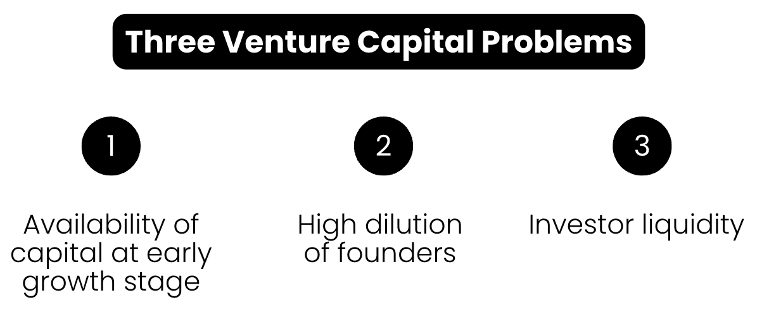

Traditional venture capital has significant challenges — investors wait years for liquidity, and impact often takes a backseat to financial returns. MAD Ventures is changing that with a smarter, structured investment model that drives both rapid scaling and measurable impact.

MAD Ventures is on a mission to ‘make a difference’, backing visionary leaders and transformative businesses that tackle the world’s most urgent challenges with scalable, sustainable, and profitable solutions.

The investment team brings deep investment and scale-up expertise with over $40 billion in collective FUM experience with backgrounds including former Macquarie Bank Global Chief Investment Officer, former Mirvac COO/CFO, former Managing Director of New Forests, and more.

MAD has also brought together a group of 25 experienced ambassadors who provide mentorship and expertise across industries, global connections, and fundraising assistance.

MAD Hyperscalers Fund I – tackling major challenges

MAD Hyperscalers Fund I is designed to address some major challenges for venture investing in Australia.

The MAD team set out to provide more capital for early growth stage, impact focussed, Australian businesses — and do this in a way that would give investors the upside of venture capital with greater liquidity & tax benefits — while actively helping founders scale faster and keeping them motivated by keeping more of their equity.

The fund invests in high-growth, impact-driven businesses in early scale-up stage that have proven themselves in the market, to deliver regular tax-effective (ESVCLP) distributions alongside long-term capital growth.

Investors target VC returns with lower volatility and quarterly distributions — without having to wait the decade-long fund cycle for distributions.

Founders get the growth capital needed to make the most of their opportunity while remaining incentivised — MAD’s structured investment approach helps founders scale their business faster while keeping more equity.

Supporting founders to make the biggest difference possible

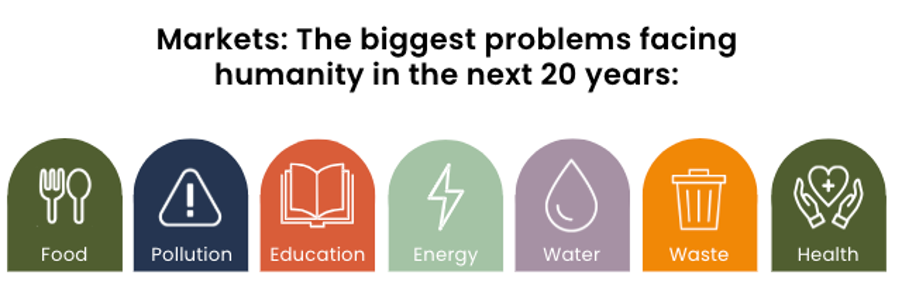

MAD backs sustainable future-focused companies in Australia that are on the cusp of rapid expansion in huge global markets, including food security (ag-tech, food-tech), environment (water, waste, pollution, circular economy, clean energy), health, and education.

Capital is deployed to scale recurring revenue streams and provide active support to maximise both impact and financial returns.

The fund invests in businesses with:

- Visionary, mission-driven founders

- Impact tied to one or more UN Sustainable Development Goals (SDGs)

- Multi-billion-dollar global market potential

- Built-in scalability and recurring revenue models

- Both income and capital growth potential

- >10x return potential

Founded by Mac Christopherson and Mark Falzon, who each bring substantial experience in building and scaling high growth companies, MAD Ventures have assembled an exceptionally experienced investment committee and scale-up experts, all driven by a shared mission — to back disruptive frontier tech companies tackling humanity’s most pressing challenges.

A unique VC model: liquidity + tax benefits

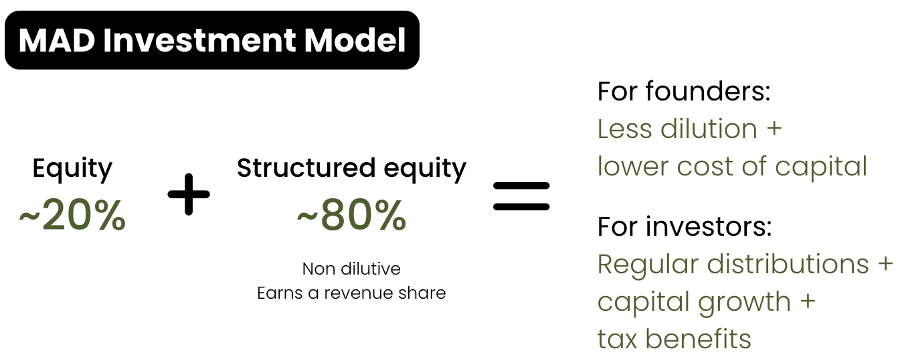

Built to address the issue of equity dilution for founders and a lack of liquidity for investors, MAD Ventures’ proprietary investment methodology, The Venture Compass, is different to the typical VC model.

The MAD Hyperscalers Fund I is targeting early-stage growth capital delivering similar expected returns to VC, but with lower volatility. This delivers better outcomes for both founders (funds for growth with less dilution) and investors (targeting similar returns with lower volatility).

Unique to MAD Ventures, the fund takes a structured investment approach that combines 20% equity and 80% structured capital.

Think of MAD’s model as a smarter blend of venture capital and private credit — offering the upside of VC with the stability of income-producing investments. Investors get quarterly cash flow while founders get the capital they need, without excessive dilution.

This model provides greater liquidity and faster return of capital, making it an attractive alternative to long-duration venture funds.

Plus, it’s tax-free for eligible investors as both the capital growth and the distributions fit within the government’s Early Stage Venture Capital Limited Partnership (ESVCLP) tax incentive, which provides tax exemption on income and gains from eligible early stage venture capital investments.

Additionally, there’s a 10% non-refundable tax rebate, meaning eligible investors can receive 10% of their investment back straight away.

A portfolio support program as unique as the investment strategy

MAD’s structured investment model is further strengthened by a high-impact portfolio engagement program, led by a Scaling-Up coach.

To really accelerate these businesses, MAD’s structured investment model is combined with a high-impact portfolio engagement program, the Scaling Up program — a methodology developed in the US by Verne Harnish who has advised thousands of companies.

The program is run for MAD’s portfolio companies, helping founders actively work on their business, build their strategy and work plans, track performance, and put a structure around the support program.

By combining institutional investment rigor with scale-up execution excellence, MAD is uniquely positioned to drive exceptional financial returns for investors.

With a leadership team that has managed over $40 billion in investments and a network of 25+ industry veterans, MAD brings institutional rigour to high-impact investing.

Importantly, for every dollar of revenue portfolio companies generate, there is a direct, measurable impact benefit, mapped against SDGs and aligned with the key themes of food security, environment/climate, health, or education.

MAD Hyperscalers Fund I: First Investments

Escavox

Escavox uses loT devices with an Al and data analytics platform to manage food quality and eradicate waste in fresh food supply chains.

The company reduces waste in fresh food supply chains by lowering the amount of fresh food that ends up in landfill and enhances food security by ensuring that as much food as possible remains fresh and is consumed.

With global expansion already underway, a groundbreaking major distribution deal secured, and a robust pipeline of high-value contracts, MAD believes the momentum of Escavox is unstoppable.

National Renewable Network

The NRN (National Renewable Network) is a unique virtual power plant that is accelerating the transition to renewable energy. It is cutting household energy costs while creating a decentralised renewable energy grid—solving energy poverty and stabilising power networks.

The business installs and owns solar panels and batteries on residential homes, providing cheaper renewable electricity for consumers while creating a distributed renewable energy generator.

This model not only accelerates the uptake of renewables but also enhances grid stability, reduces costs, and improves power reliability.

With month-on-month growth exceeding 15%, NRN is now on the cusp of rapid expansion, supported by a robust pipeline and significant contract opportunities.

MAD Hyperscalers Fund I is now accepting investors — don’t miss the opportunity to be part of the next wave of impact-driven, high-growth businesses.

Learn more or secure your spot today: https://mad.vc/more-info or contact hello@madventures.au.

Impact Investment Summit Asia Pacific 2025

The Early Bird offer for the 2025 Impact Investment Summit Asia Pacific (26/27 March at the ICC in Sydney) ends today — Friday February 7. Save $600 on the 2-day ticket price and $365 on the 1-day ticket price.

Click here to buy your ticket: https://events.humanitix.com/impactinvestmentsummit2025/tickets