Leading not-for-profit social impact investment fund manager For Purpose Investment Partners (FPIP) has released its Impact Report 2024, outlining its approach to impact measurement and the performance of portfolio companies and projects.

FPIP co-founder and pioneering impact investor Michael Traill spoke to OnImpact about the past year’s “remarkable period of growth and achievement,” including the group’s “landmark commitment from institutional investors to our aged care platform” and an acquisition that will see its aged care platform become a top-15 aged care provider.

Established in 2018 by Traill and philanthropist and entrepreneur Mark Carnegie to focus on large-scale impact investing, FPIP now has around $185 million of funds under management.

FPIP is pursuing a broader ambition to establish social impact investments as a viable asset class for large-scale transactions across the Australian market. It is bringing private sector capital and capabilities into sizeable businesses and projects to create significant social impact.

Traill said, “Publishing transparent and accountable information in our Impact Report 2024 is a demonstration of our thought leadership in impact investing. We believe transparent reporting is a factor in building the understanding and assurance amongst investors to unlock significant amounts of capital that can transform the social sector.”

Traill, who also chaired the Federal Government’s Social Impact Investing Task Force, further explains, “Ultimately, we need to get to scale to tackle the sector-wide transformation that is needed in areas including aged care, disability, education and housing.

“Institutional investors need to know that impact fund managers are transparent, accountable and creating value. Proof points like our annual Impact Report, are part of the assurance that investors require.”

First institutional investment

Traill highlighted this year’s “breakthrough partnership” — a $75 million commitment from Qantas Super in April 2024, its first institutional investment, alongside a $10 million commitment from Australian Ethical Investment to the FPACA platform, which is FPIP’s not-for-profit aged care platform.

“The backing of Qantas Super and Australian Ethical is a strong proof point of a shared passion for solving social issues to improve the lives of Australians,” said Traill. “Our first fund, Social Impact Fund I is almost fully committed and on the back of these strong foundations we are in the market for further funding.”

Qantas Super CIO Andrew Spence said, “We’re very open to backing early stage or first-time fund managers which has been a consistent source of value add for Qantas Super’s members.

“Our focus is on identifying a manager’s sustainable competitive advantage in terms of people, capability, alignment of interest, and a strong track record. Michael has assembled an outstanding team who share the twin passions of delivering attractive financial returns, which is our first priority, and a strong ethical focus.

“For us, it’s always about partnering with the right talent. With our team having worked very closely with the For Purpose team, we are confident our investment partnership is in good hands.”

Aged care platform growth

Another highlight for the year was FPIP’s acquisition of family-owned residential aged care provider Signature Care, which will see FPACA increase its initial 1,394 residential aged care places to over 2,500 places within two years across 18 sites in New South Wales, Victoria, Queensland, and Western Australia. Together with its existing Luson portfolio, the acquisition will see FPACA become a top-15 aged care provider.

BlueMark OPIM and continuous improvement

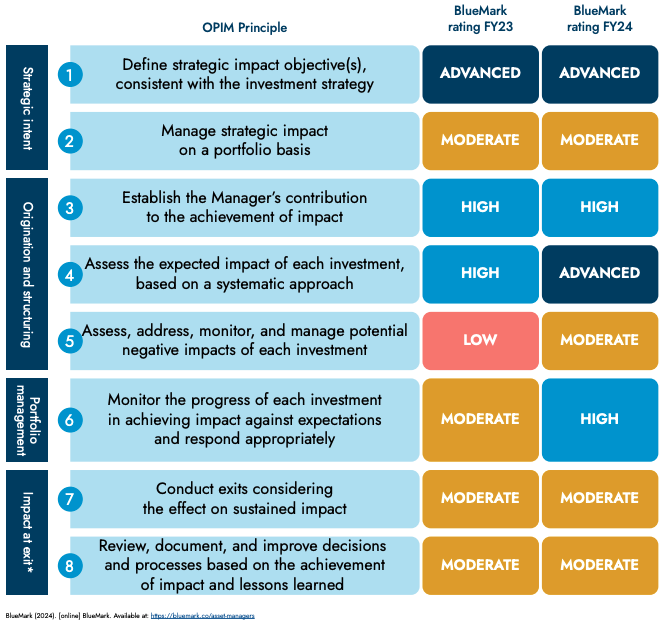

The lack of clear guidance in impact investing can increase the risk of impact washing, for this reason FPIP became one of Australia’s first signatories to the Operating Principles for Impact Management (OPIM) and were independently assessed by BlueMark against these principles. This process contributes to building trust in the market, while benchmarking its performance against global impact managers.

Traill explained, “Our values and commitment to transparency led us to seek external verification that provides investors with confidence that we have been benchmarked and tested to a global standard.

The FY24 assessment has shown great progress with improvement across three ratings:

“We are focused on continuous improvement and this was evidenced by a lift in ratings across three of the eight principles this year. As a team we will continue to work in close partnership with our investees to increase our collective impact. We are demonstrating Australian impact to a global standard.”

Focused on continuous improvement, FPIP will continue to update and adjust its approach, systems and processes, as it strived to align with best-in-class practices.

Quality, inclusion and advocacy

“There’s a common denominator in each of the investment partnerships — we focus on quality, we focus on inclusion and we focus on advocacy. Then within that there are subtle but significant measures that are very specific to the industries that we work in.

“There’s a really strong cultural approach that we need to lean into, we need to be very honest and transparent about what’s working and what isn’t.

“We really want to focus on providing outstanding customer service in a very authentic way and particularly in the human service sector. That’s about the quality of the relationship, the quality of the engagement, the culture of what happens, particularly in service sectors, like aged care and further education.

“If you’re not providing high quality support, you don’t deserve to get repeat business.”

“There’s a tight nexus between doing an outstanding job on quality and actually progressing people to have better quality lives and to realise their potential. We feel very strongly about that.”

The FPIP Impact Report 2024 is available here.

Be sure to subscribe to the free OnImpact newsletter here, and follow us on LinkedIn.