Convergence, supported by the Department of Foreign Affairs and Trade (DFAT) and the Foundations Group for Impact Investing (FGII), recently held two workshops on blended finance.

Convergence is the global network for blended finance that aims to increase private investment in emerging markets and developing economies to advance the UN Sustainable Development Goals (SDGs) and the Paris Agreement.

Convergence CEO Joan Larrea, who has close to 30 years of experience in emerging markets’ investing and is an expert in catalysing investment, presented at the workshops in Sydney and Melbourne as a special guest speaker. Joan has broad experience structuring impactful transactions over her career that has included time at the World Bank, Global Environment Fund and the US Overseas Private Investment Corporation (OPIC).

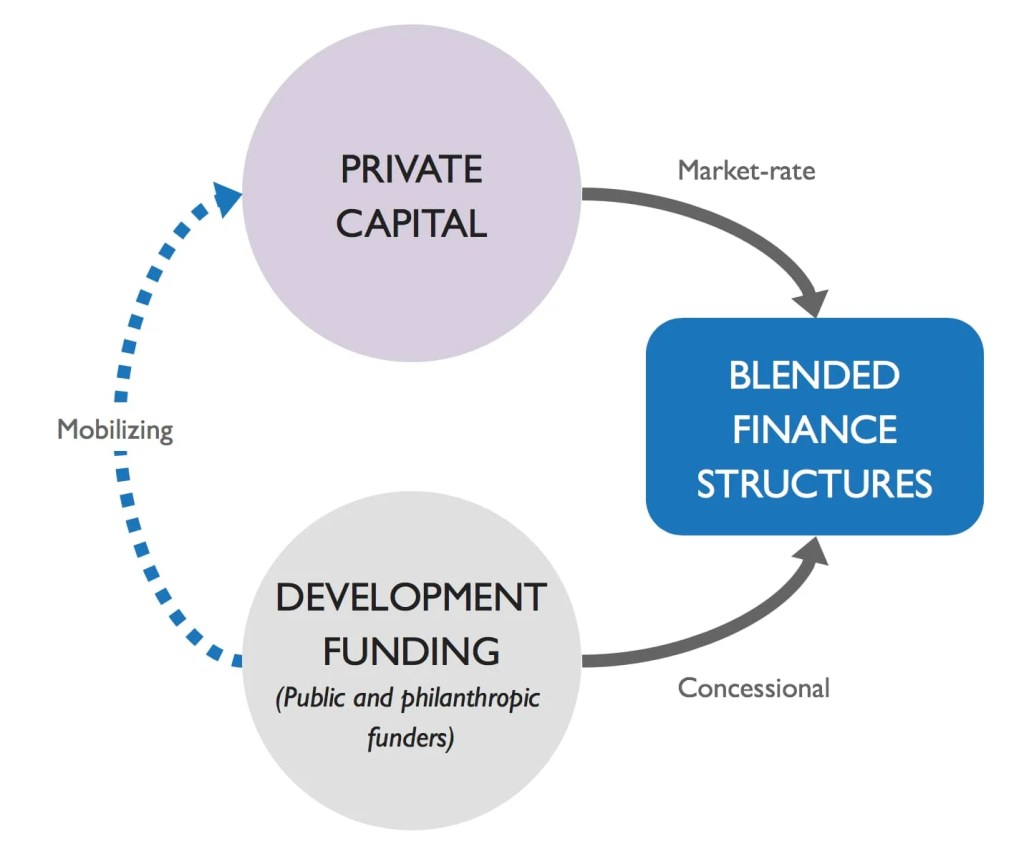

Blended finance is a structuring approach that allows organisations with different objectives to invest alongside each other, while achieving their own objectives — financial, impact or a combination of both. A blended transaction allows for the mobilisation of additional finance, that wouldn’t otherwise participate, in a deal designed to create social or environmental impact.

Workshop participants included stakeholders across the capital continuum, including those from Australian Foundations and Family Offices, who were introduced to a new approach to financial structuring to drive high-impact outcomes both in Australia and in developing countries.

Workshop topics included:

- How blended finance approaches can be applied domestically.

- How a foundation’s mandate can be adjusted to allow its corpus or endowment to participate in a mission-aligned blended finance transaction.

- The difference between impact investing and blended finance. Hint: impact investing is a portfolio investing approach, whereas blended finance is a financial engineering or structuring approach to solve market failures. Impact investors often participate in blended finance transactions.

- The roles of intermediaries in blended finance and why organisations need to work with their financial advisers, impact advisers and boards to help them better understand when to consider a blended finance transaction.

- The most common proponents in a blended finance transaction.

- When not to use blended finance to solve a social issue.

Philanthropy Australia’s outlined its key takeaways from the workshops as:

- When designing blended finance structures – consider scalable structures that are recognisable to institutional investors. The goal is to get them over time to be big, boring (in their financial structure) and able to be repeated.

- If investing catalytically, use the power of your scarce catalytic money up front to get important commitments from partners on expected impact, future reporting, data and transparency requirements.

- Blended finance transactions require different parties that don’t normally interact to collaborate. Start connecting with institutional investors, development agencies, NGO’s and other foundations or family offices to learn from each other or collaborate on solutions.

DFAT blended finance mechanisms

In response to the need to mobilise more private finance towards development outcomes, DFAT has been using blended finance approaches in the aid and development program across the region since 2013 and has scaled-up this approach since 2023.

DFAT has several investment mechanisms:

- Australian Development Investments (ADI) – Australia’s $250 million impact investment that invests in small and medium enterprises in the region to deliver climate and gender outcomes;

- Private Infrastructure Development Group (PIDG) – an infrastructure project developer and investor tha mobilises private investment in sustainable and inclusive infrastructure;

- Australian Climate Finance Partnership (ACFP) – Australia’s A$140 million concessional financing facility managed by the Asian Development Bank, which helps mobilise private sector investment into low emission, climate-resilient solutions for developing countries in the Pacific and Southeast Asia.

DFAT’s partnership with Convergence provides DFAT and its partners (including other government partners and private financing partners) with access to Convergence’s analytical, technical support and training capabilities. DFAT also supports the scale-up of new blended finance structures by running competitive design funding rounds through Convergence.

DFAT’s Blended Finance and Investor Engagement Unit can be contacted at blended.finance@dfat.gov.au. Contact us for more information on how your organisation can invest alongside DFAT’s blended finance mechanisms in developing countries in the Indo-Pacific region.

Want to learn more about blended finance?

Convergence provides free online resources including, Blended Finance 101 training, case studies and regular publication of the State of Blended Finance in Developing Economies report to help organisations increase their blended finance literacy. These resources can be accessed here: Blended Finance | Convergence.