“Non-sustainable just doesn’t make sense anymore. We just can’t keep screwing our planet and pillaging it. We have to put a price on what resources we’re taking, because those resources aren’t yours, they’re actually everyones.”

— Tobi Nagy, Founding Partner and Executive Director of Asia Venture Fund.

Tobi Nagy — a serial entrepreneur, innovator, mentor, educator, and investor, with 30 years of experience in startup and entrepreneur development and education — is now applying his experience and passion for sustainability to develop Asia Venture Fund.

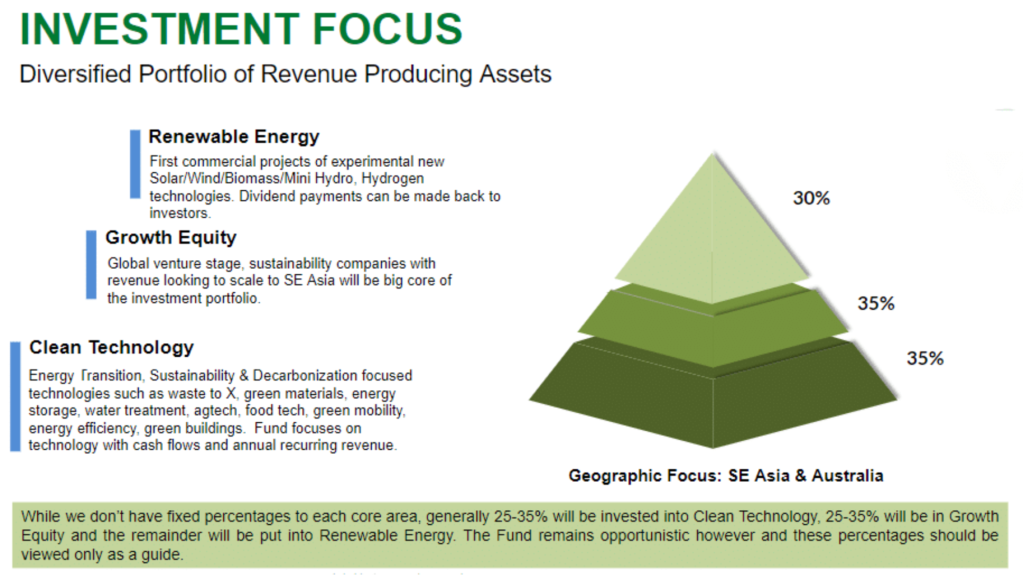

The primary investment focus of Asia Venture Fund is companies developing technologies to reduce global carbon intensity and create a circular economy, which are ready for commercialisation. Importantly, the fund not only invests in these companies across clean tech, green tech and climate tech, but helps build out their projects.

Tobi explained, “The fund takes a very hands-on approach to funding businesses to ensure the right businesses are chosen — those where a fast track to commercial viability is possible within two to three years.

“The entrepreneurs that are running these projects, they’ve got great projects, but they really struggle with getting it over the line.”

Toby said that this is particularly true for those seeking $5-$10 million, who face the start-up valley of death — after research funding drops and before commercialisation funding increases.

“It’s not hard to raise like $50-$150 million, but it’s really hard to raise between $5-$10 million as nobody wants to be in there early and take the risk. Whereas we’re okay with that because we understand sustainability and we understand startups and enterprise and how we can actually de-risk the whole business.

“We are a commercializer. We look for whether they have a pilot plant, that they want to come into the Australia, Indonesia, or Singapore markets, and they have to be scalable. We have to be able to scale them.

“Our portfolio is quite broad and we’re doing all types of projects — things like renewable energy, waste energy, waste-to-X, water sanitation, pollution remediation, wastewater remediation, green housing, and green transport systems.

Some of the current Asia Venture Fund deals now under review include:

- A high-efficiency lubricant oil recycling facility.

- Revolutionary waste prevention system before they enter waterways.

- Soil remediation technology that enhances agricultural yield.

- Waste-to-energy closed-loop system that recycles organic waste.

- Fin-tech solution for electric scooters (for delivery drivers), solar systems, and water pumps (for agriculture).

- Wind turbine blades and solar panels end-of-life recycling.

- Vertical farming low-cost scalable system.

- Meat replacement wholesale food distribution products for Asia, Australia, the USA, and the UK.

- H2-On-Demand injection system for diesel engines (marine/truck) to increase their performance by 15%.

While Tobi is now based in Bali, where he wants to base his venture studio, the fund is domiciled in Singapore with a focus primarily on Indonesia, Malaysia, Singapore and Australia, although he says they will look at technology coming from anywhere.

The Asia Venture Fund team has 150 years of combined industrial experience with a solid mix of entrepreneurial, corporate, venture capital, project finance, and academia. This includes significant experience in developing renewable energy, waste-to-x, water, and hydrogen projects. They have also mentored multiple clean technology companies for their strategies in funding, business, marketing, financials, engineering, advertising, and sales.

Notably, they have a wide and active network and speaking engagements at energy/waste/water conferences that provide continuous, quality, deal flow.

Fund details

The hybrid fund aims to give investors blended returns consisting of target dividends and above-average total returns in what is expected to be a lucrative environment. Whilst seeking to generate competitive financial returns, the fund is also fostering positive environmental, social, and governance (ESG) outcomes.

- Target Size: US$100 million AUM

- Investment Period: 5-7 years

- Minimum investment: US$1 million

- Fee Structure: 2%/20%

- Investment Focus: Pioneering projects and technology startups in Southeast Asia and Australia focused on energy transition, sustainability, and decarbonisation.

For more information see www.asiaventure.fund, email tobi@asiaventure.fund , or call +61 432-551-505. You can also reach Tobi Nagy on LinkedIn.

Hi, keen to connect regarding a Series A for Sustainable Fashion Ventures. David Connolly

Sure David, let’s connect on LinkedIn

Cheers

Tobi